Institute of Customer Service response to Department of Business, Innovation and Skills consultation on Tipping, Gratuities, Cover and Service Charges

The Institute of Customer Service (The Institute) is an independent not for profit professional membership body, with over 500 organisational members. Our purpose is to help organisations improve their business performance through excellent customer service.

Summary

The Institute of Customer Service supports the Government’s examination of the treatment of discretionary service payments. The practice of some businesses noted in the consultation document highlights the lack of clarity, consistency and understanding around how such payments are paid to, and received by, workers and discrepancies with the expectations of consumers. This lack of clarity and understanding is harmful for business as it undermines employee engagement and erodes customer trust. Long term sustainable performance for any business relies on engaged staff delivering a high quality service experience to meet the needs of their customers.

Our research shows that employee attitude and behaviour has a significant impact on customer satisfaction. Where customers perceive employees to be highly engaged, friendly, helpful and enthusiastic they are much more likely to recommend that business to others or buy from them again. However, employees will only be fully engaged and deliver that level of service if they feel they are treated fairly and, when it comes to payments for service, that they see a personal benefit from going the extra mile with customers. The lack of clarity and consistency and the mismatch of expectations is caused by a complex collection of legislation, regulation, business behaviour and social norms.

The government should seek to establish a new norm for service charges and a new understanding between business, customers and employees in which:

- customers should be able to offer payments for service directly to those who serve them, only if they choose to, at a level they think appropriate, and without interference from a business,

- employees will understand that if they work hard to provide an excellent service they will be the direct recipient of any reward payments,

- customers should also be confident that a business will not ultimately receive any proportion of their payment and they are rewarding just the employees,

- businesses will understand that this arrangement will be beneficial for them as they will gain from more engaged staff, delivering better service and therefore improving their long-term relationship with customers.

To achieve this, Government should intervene via consumer protection legislation and other regulation to prevent businesses from recommending or adding service charges to a bill or from making any deductions to payments for service to employees other than those required for tax purposes.

Our Research

UK Customer Satisfaction Index

The Institute of Customer Service publishes the UK Customer Satisfaction Index (UKCSI) twice per year based on over 39,000 customer responses and nearly 30 measures essential to excellent service. The Index ranks overall satisfaction at a national, sector and organisational level out of 100. The January 2016 UKCSI shows that customer satisfaction has improved across most sectors and is now at its highest level for two years. In the leisure sector (which includes restaurants, cafes, bars, etc) there was a 0.7 increase in customer satisfaction to 79.0 compared to January 2015, in the tourism sector (which includes hotels) the increase was 0.3 to 79.7 and in services (which includes local tradespeople) the increase was 0.5 to 77.5. While this is positive, it is pertinent to note that insight in the UKCSI also signposts the factors shaping customers’ needs and preferences.

Customers are seeking more personalised, authentic and relevant experiences where trust, transparency and ease of doing business are paramount. In 1 out of 4 cases, they are also willing to pay more if it means securing better customer service.

Employee Engagement research

Our response also draws heavily on The Institute’s research on employee engagement. This included a survey of over 2,000 customers looking at the tangible impacts of employee engagement resulting in positive customer behaviours such as loyalty, repeat purchase and recommendation. It found that 69% of people who have memorably good service go on to make a recommendation to others about the company, 62% will go on to buy again from the same organisation and 51% will buy an additional product or service.

Bespoke research

Bespoke research has been undertaken specifically for this consultation. An online survey of 2,014 UK residents in full time employment was conducted between 23 and 31 May 2016. We have also included a sub-set in the data of business executives, people who hold senior roles either responsible for managing teams, projects, departments or organisations. This allows us to compare overall consumer opinion with a sub-set of consumers that may also be more sensitive to the business perspective. The full results are detailed in Annex 1.

Option 1: Ensure transparency to consumers that discretionary payment for service is just that – ‘discretionary’

It is clear that there is an issue with transparency around discretionary service payments. The consultation itself sets out the array of differences between gratuities, tips, service charges and cover charges that would require the customer to have a nuanced understanding of in order to work out whether monies left end up with staff or not. Additionally, Figure 1 sets out the varying legislative frameworks that are in place for the National Minimum Wage, Income Tax, National Insurance Contributions and consumer protection from unfair trading that apply to the differing type of payments. This complexity for what is a relatively simple concept is not good for customers, employees or businesses. The results from our bespoke survey reflect a frustration with the complexity.

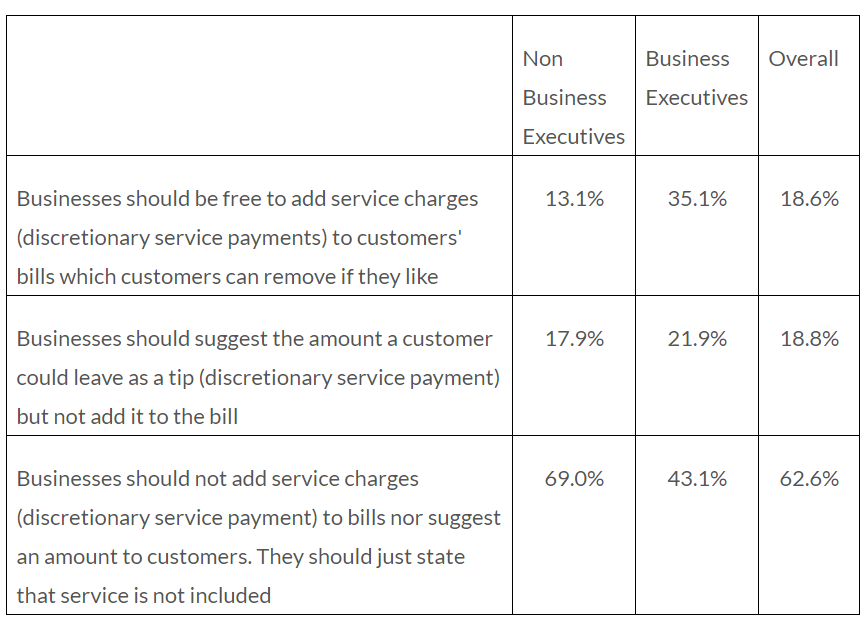

There is a clear majority across consumers and business executives that support government changing consumer protection law to ensure that businesses are transparent about discretionary payments (88.5% of business executives and 84% of consumers overall support government intervention).The current variety of options facing a customer lead to confusion about whether a tip is required on top of a set service charge and what proportion of any monies left will end up with the employee who provided them with excellent customer service. The best solution to this is to unequivocally make the payment a matter between the customer and those that provide a service to them. The Institute therefore supports government intervention to prevent businesses from suggesting service payments to customers. As shown below in the extract from our bespoke survey result, this position is supported by 63% of consumers overall, as well as 43% of business executives.

Question 7: Which option (or group of options) do you think best meets the Government’s objective to ensure all discretionary payments for service are clearly seen as voluntary for the consumer?

Option 1B. Businesses should merely make the customer aware that a discretionary service has not been added. It will be entirely up to the customer to decide whether to leave a discretionary payment for service without being prompted, in essence an ‘opt-in’approach. This is the simplest, and therefore most transparent, approach for customers. It is also supported by the majority of consumers in our survey and a large proportion of business executives as noted above.

Question 8: Do you expect the ability of consumers to make payments for goods and services by card would be affected by any of the proposals set out within Option 1?

For The Institute’s preferred option (1B), consumers should be able continue to make payments for goods and services, as well as discretionary service payments on top of their bills, as they do now. Businesses will just not be able to suggest the level of service payments or automatically add any.

There is a possibility that businesses may be disincentivised to allow service payments to be added to bills when a customer pays by card if the business will have to absorb the costs of passing on such payments to staff (as outlined by option 2A which the Institute supports). As noted below, we think that any costs for the business in passing on service payments will be outweighed by the business benefits accruing from an engaged and motivated workforce delivering excellent customer service and it would therefore not make long-term commercial sense to make it harder for customers to leave payments for service via card payments. Question 9: Can you suggest any other options to ensure transparency to consumers that voluntary payments are discretionary? Preventing businesses from adding or suggesting services charges would create a new norm in business behaviour and therefore provide clarity for consumers.

Question 10: Do you consider the current regulatory frameworks appropriate to enforce proposals to ensure that any suggestion of a discretionary payment for service emphasises that this is discretionary for the consumer?

No.

Question 11: If no, what additional enforcement measures would you suggest?

The Institute is generally supportive of ‘light touch’ regulation which frees businesses to focus on providing excellent service and therefore improve their relationships with customers. However, in this case in order to implement option 1B there will need to be a change in regulation. This could be via an updated Code of Practice which the Institute thinks should be put on a statutory footing (please see our response below under Option 3).

The government should also review consumer protection legislation and investigate possible amendments. As noted above, our bespoke survey reveals that 88.5% of business executives and 84% of consumers overall support government changing consumer protection laws to ensure that businesses are transparent about service payments. The emphasis of any regulatory changes should be simplicity.

Option 2: Ensure workers receive a fair share from discretionary payments for service

Institute research suggests that the perception of fair treatment by employers is a critical factor in employees feeling engaged and motivated to provide levels of customer service that secure loyalty, repeat purchase and recommendation.

When considering the options for ensuring workers receive a fair share of discretionary payments we believe that it is in business’ interests to have a system in place that delivers maximum engagement. When a discretionary payment is made in cash there is an expectation from consumers that this is a straight forward transaction between the customer and service provider that does not necessarily involve the business. The expectation is that the customer is clearly leaving a discretionary payment to reward the level of customer service that they received and that this will be enjoyed by the employee (with recognition that they still need to pay appropriate taxes). In this scenario the employee has maximum reason to be engaged because they will receive the whole of the payment (or in a Tronc system will share that with co-workers).

The Institute thinks that government should ensure the reality of business behaviour matches this consumer expectation. However, there is an added layer of complexity when a non-cash payment is made that inevitably brings the business and their administrative costs into the equation, and it is possible consumers have an increasing understanding of this. The government should address both scenarios in the same way to maximise clarity.

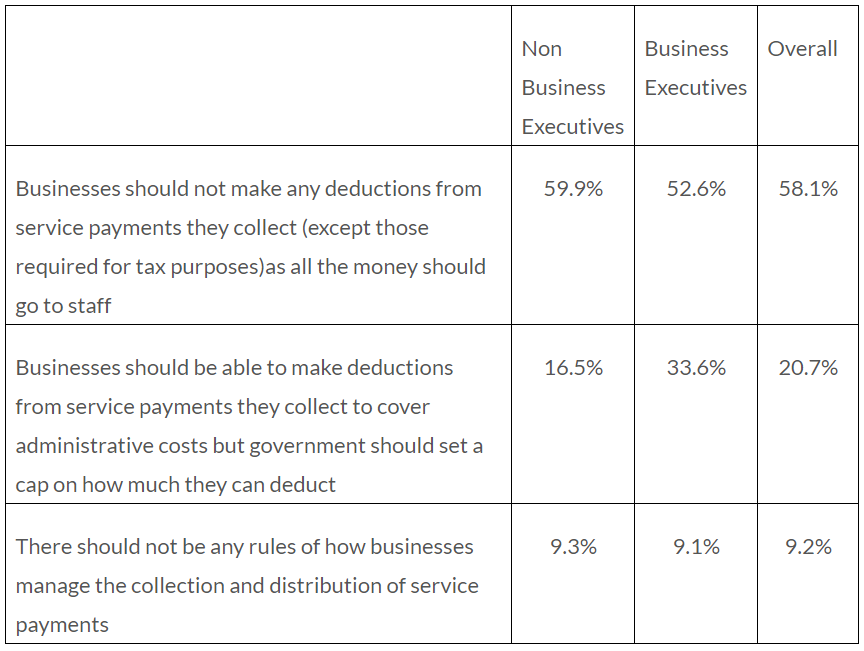

The Institute’s research shows that 58.1% of our bespoke survey respondents believe that businesses should not make any deductions from service payments they collect or process on behalf of employees (except those required for tax purposes) as all money should go to staff. A further 20.7% believed that deductions should be allowed to cover administrative costs but that these should be capped by Government. (See survey extract below).

It is relevant here to look also at the business executive sub-set of the sample as it is here that there will be greatest awareness and sensitivity about the costs associated for a business with administration.

While a significantly greater proportion of business executives than consumers overall supported deductions to cover administration (33.6% vs 20.7%), it remains the case that the majority of this sample also supported no deductions by employers other than those to cover tax (52.6% vs 59.9% amongst non-executive respondents).

The Institute therefore supports preventing employers from making deductions for any administrative costs associated with handling service payments from consumers to employees. The Institute recognises that there will be costs for business from card handling and payroll administration but believes that these will be outweighed by the business benefits accruing from an engaged and motivated workforce delivering excellent customer service. Providing a level of service that will lead to repeat visits and recommendations from customers is worth the marginal investment associated with absorbing administrative costs.

Furthermore, taken with our proposals to prevent businesses from suggesting or adding services charges to bills, this will provide maximum clarity for consumers in how any service payments are treated.

Options 1B and 2A together mean that consumers will be sure that they are free to make service payments if they wish and to the level they want, without interference from the business, and that any such payments go in their entirety to the staff that served them.

Question 12: Which option (or group of options) do you prefer to meet the Government’s objective to ensure workers receive a fair share from discretionary payments for service?

Option 2A. Please see above, this option provides clarity for consumers, maximises engagement from employees and is supported by the majority of consumers overall and business executives.

Question 13: Can you suggest any other options to ensure workers receive a fair share from discretionary payments for service.

Option 2A will ensure workers received the entirety of any payments for service.

Question 17: Which option for troncs (guidance or rules) do you think is most suitable to achieve the Government’s stated objectives?

The Institute thinks troncs are positive and should be incentivised, but that the same principles should be applied to them as those that are applied to non-pooled discretionary payments (i.e. that they receive the total payments made in order to maximise employee engagement and resulting business benefits).

The position for cash payments is relatively straight forward with the troncmaster being responsible for the division among members (and any necessary tax liabilities). However, additional complexity is added when the employer becomes involved through non-cash payment distribution.

The Institute notes the consultation’s comments from previous calls for evidence that employers believe the current rules are burdensome and complex, while workers believe that employers’ involvement leads to administrative charges and attract National Insurance Contribution payments that would otherwise have not been necessary.

To ensure that this feeling is avoided, the Government should make clear that the ban on administrative deductions also applies to tronc systems, and offer guidance on what constitutes the ‘correct operation’ of a tronc, to ensure National Insurance Contribution payments are not made.

Guidance that is put on a statutory basis but which has its reach strictly limited to essential aspects of a tronc would be the best way to implement this policy.

Question 18: Do you consider the current regulatory frameworks (Annex B) appropriate to for enforce proposals to ensure that workers receive a fair share from discretionary payments service?

No.

Question 19: If no, what additional enforcement measures would you suggest? Please reference your suggestions to specific consultation options where possible

The Institute is generally supportive of ‘light touch’ regulation as noted above. However, in this case in order to implement option 1B there will need to be a change in regulation. This could be via an updated Code of Practice which the Institute thinks should be put on a statutory footing (please see our response below under Option 3) or some other mechanism.

This is a stance supported by the survey conducted specifically to respond to this consultation which found that overall 61.3% of respondents agreed that Government should regulate any deductions from service payments for staff businesses make, indeed even amongst the business executive sub-set which might be expected to be most sensitive to additional regulation there was 69.7% support for Government taking action.

Option 3: Increase transparency for consumers and workers regarding the treatment of discretionary payments for service

The Institute is generally supportive of ‘light touch’ regulation as noted above. In relation to the Code of Practice there is a balance to be struck between a voluntary code of practice with poor awareness, which undermines its efficacy, versus burdensome regulation which could stifle business innovation.

The Institute is in favour of applying a Statutory Code (Option 3B) but one which is based on the simplicity offered by Options 1B) and 2A) as set out in the consultation document. The survey conducted specifically to respond to this consultation demonstrates support for both these options and government intervention to implement these polices.

However, there is a responsibility on Government when considering regulation and statutory rules to keep them simple. The Institute is clear that rules preventing business from suggesting discretionary payment levels and ensuring that employers administering non-cash payments are not able to deduct anything other than tax are as minimal as possible.

Such a system will enable a level playing field amongst employers by preventing any unfair competition with employers that have in the past created revenue streams from discretionary payment deductions. However, The Institute is clear that the major benefit for business will be better employee engagement because of a perception of fair treatment and reward which will in turn improve customer service and lead to repeat custom and recommendation.

Question 21: Which option(s) outlined in this section (3A and 3B) do you consider would best support the proposals under Options 1 and 2 to achieve the Government’s stated objectives?

Option 3B. A change in regulation will be required to implement options Options 1B) and 2A) and this is supported by our survey of consumers.

[1] The Institute of Customer Service, UK Customer Satisfaction Index – Leisure, Tourism and Services sector results (January 2016) [2] UK Customer Satisfaction Index – The state of customer satisfaction in the UK – January 2015. The Institute of Customer Service, (January 2015). Summary Report, p10 [3]The Institute of Customer Service, Are you being engaged? – Employee engagement and its influence on customer satisfaction and buying behaviour, (2014)

Comments (0)